3 fascinating lessons the “Magnificent Seven” US tech stocks can teach you about investing

When you hear the phrase “Magnificent Seven”, you might immediately think of the classic 1960 Western movie, The Magnificent Seven.

But in fact, the phrase is being used to describe a new group of powerful entities: the seven most valuable companies on the US stock market, all of which are technology businesses.

As of May 2024, the Magnificent Seven is made up of:

- Tesla

- Nvidia (the world’s leading tech chip manufacturer)

- Microsoft

- Amazon

- Meta (formerly known as Facebook)

- Alphabet (Google’s parent company)

- Apple

These seven technology stocks have made huge waves in both US and global markets in the last 12 months. And as they grew in popularity, so did investors’ eagerness towards them; to many, these companies seemed too big to fail.

So, you might be wondering: “What’s so special about the Magnificent Seven, and is it wise to invest in them?”

Here are three fascinating lessons to learn from the Magnificent Seven’s rise to stock market domination.

1. Investment bubbles can be extremely tempting for investors

Before we dive into the Magnificent Seven’s 2024 performance, it’s important to contextualise why this group of large cap tech stocks gained so much attention in 2023.

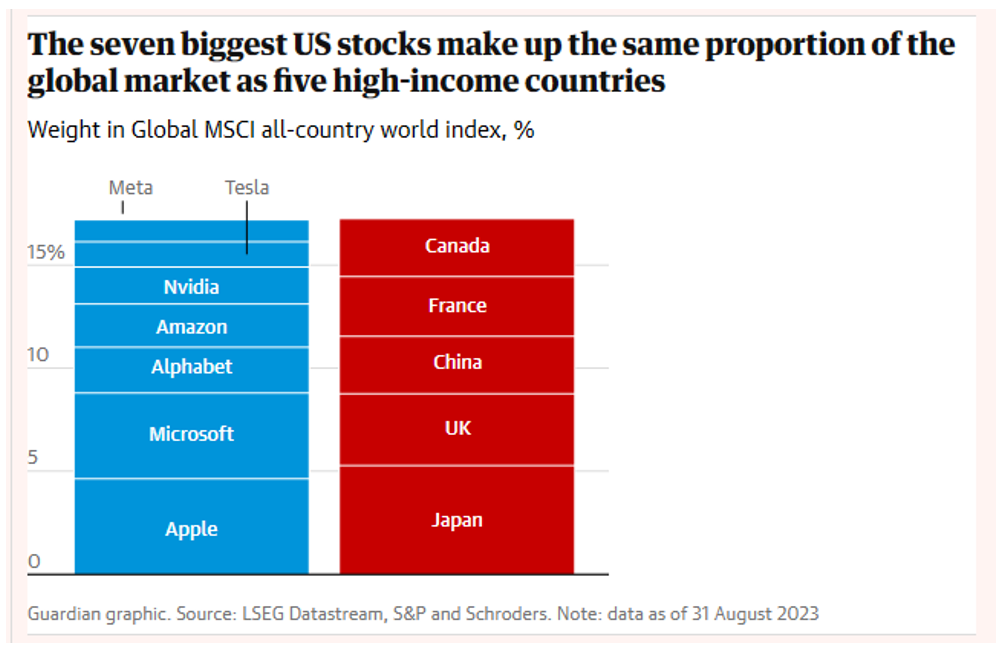

Believe it or not, as of August 2023, the Magnificent Seven made up the same proportion of the global market as the UK, Canada, China, France, and Japan combined.

Source: the Guardian

Of course, their success contributed to the positive returns posted by US markets in the second half of the year. CNN reports that as a group, the Magnificent Seven produced a 75.6% return in 2023, having a heavy influence on the US S&P 500’s 24.2 growth in the same time period.

For some, the Magnificent Seven represent an investment “bubble” – a boom in investor activity around a certain commodity, like technology, that leads to the overinflation of that commodity’s share value.

Remember, markets are affected by investors’ behaviour. So, once investors caught wind of these companies’ successes, many wanted a share of the bounty – leading to further growth for the Magnificent Seven.

However, while 2023 was an exciting time for tech investors (or anyone who wanted to capitalise on the Magnificent Seven’s growth), some were cautious that the Magnificent Seven’s prices were becoming overinflated. This caused some concerns that investors would experience financial losses if the bubble were to eventually burst.

All in all, the lesson here is that while investment bubbles are extremely tempting for investors, it is important to ask yourself if the decisions you’re making are set to help you over the long term or if your excitement is getting the better of you.

2. No company is too big to fail

Even companies as herculean as the Magnificent Seven can experience hits, losses, and volatility – and recent stock market data serves as proof of this.

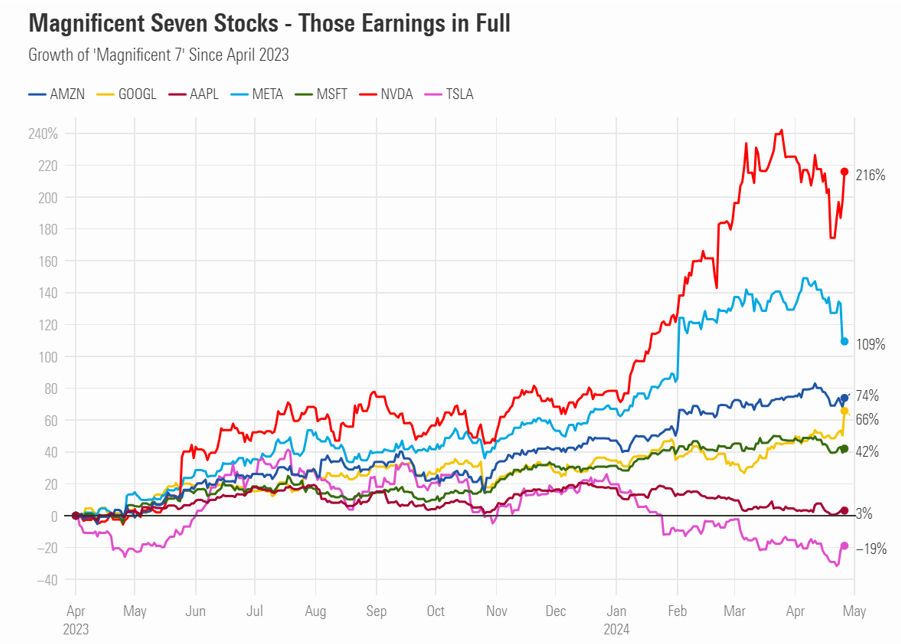

The below graph shows the market performance of the Magnificent Seven between April 2023 and May 2024.

Source: Morningstar

As you can see, while some of the Magnificent Seven are still making significant progress in 2024, others – Tesla, Apple, and Microsoft – have begun to flatline, or even declined in value since the start of the year.

This graph teaches us that:

- While there is nothing wrong with investing in popular stocks, no company is too big to fail

- Buying up stocks at an inflated price could lead to disappointment later

- Taking a long-term view of your investments could lead to more lucrative results.

Nobody knows what the future holds for each of the Magnificent Seven companies. What we do know is that a technology company’s share price can be affected by so many factors, including:

- Governance issues, such as the replacement of a key company leader

- International commerce delays, as many of these companies rely on overseas labour and manufacturing

- Changes in consumer trends

- New competitors entering the market.

The most important thing to remember as an investor is that no company is untouchable, even international corporations like the Magnificent Seven.

3. Taking a long-term view of your investments could help you achieve the “best of both worlds”

Just like there is no “magic stock” that will make you rich beyond your wildest dreams, there is also no “evil stock” that is destined to hurt your chances of returns.

Instead of seeing potential assets as “good” or “bad”, including those in the Magnificent Seven, it could help to look at how an acquisition may fit into your portfolio as a whole.

For example, the Magnificent Seven are all listed on the US stock market. According to Visual Capitalist, as of Q2 2023, the US made up 42.5% of the global market.

As such, it makes sense to include some US holdings in your portfolio to achieve a diversified selection. But, overexposure to US assets could cause a problem too.

If you became overexcited about the Magnificent Seven in 2023, you might now have a portfolio that is heavily weighted in US technology stocks, potentially unbalancing your diversification and risk levels. Or, if a large chunk of your portfolio is made up by companies listed on the US S&P 500, remember that the Magnificent Seven have an enormous influence on this index due to their extraordinary value.

In either case, it may help to “zoom out” and look at your entire portfolio before focusing on these specific companies, or indeed, any particular asset class.

Looking at the big picture could help you to:

- View your investments as a long-term project

- Ensure your portfolio is appropriately diversified

- Align your investments with your appetite for risk

- Create an investment strategy designed for you and your family.

Making decisions based on your long-term financial plan could help you capitalise on opportunities like the Magnificent Seven without thoughtlessly overinvesting.

Financial advice could help you build a long-term investment strategy

Working with a financial adviser could give you the confidence and knowledge you need to invest according to your goals.

To speak to us about investing for your future, email info@chancellorfinancial.co.uk, or call 01204 526 846 to speak to an adviser.

If you’re already a client here at Chancellor, contact your personal financial adviser to discuss any of the content you’ve read in this article.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.